The NJ Division of Taxation requires that you file an accurate return. The Inheritance Tax Section routinely reviews and audits inheritance tax returns. It is important that you exercise due diligence by retaining an experienced tax accountant to represent you. We have filed hundreds of estate and inheritance tax returns for NJ taxpayers.

Typically, the estate pays the accounting/tax preparation fee (which is a deduction on the return). Additionally, by retaining a tax professional, both the executor and the beneficiaries will benefit by avoiding errors due to inexperience in these matters.

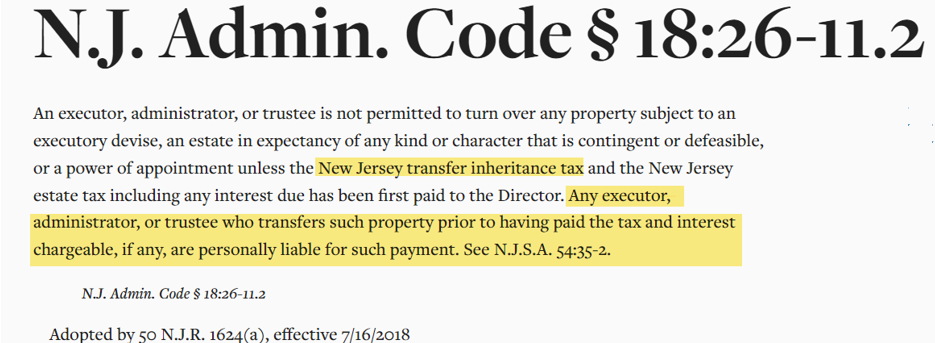

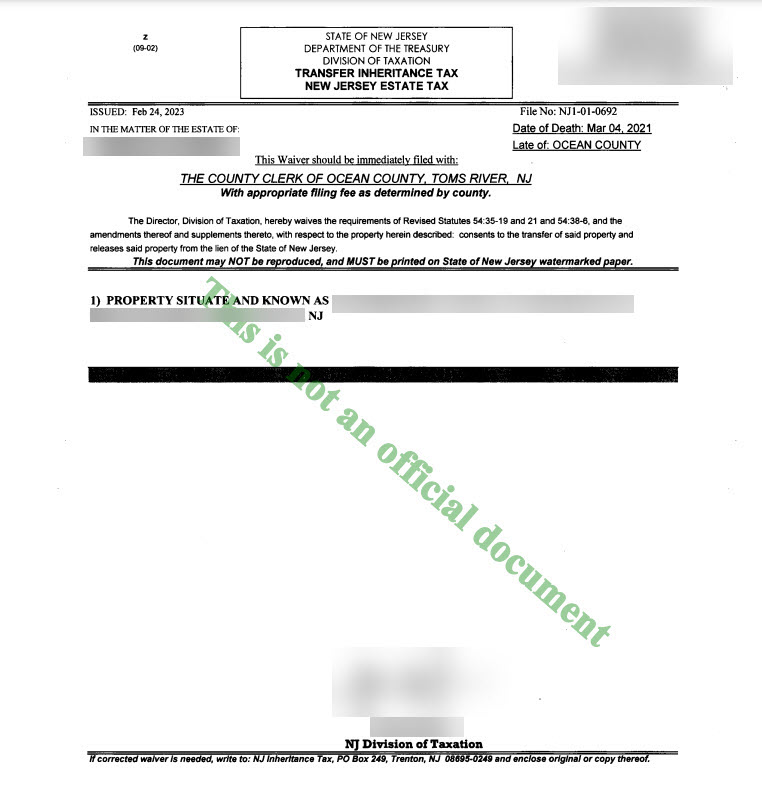

If any of the estate beneficiaries are not Class A beneficiaries, 50% of financial assets such as brokerage and bank accounts are usually "frozen" until the NJ Division of Taxation issues an official waiver to release the funds. Also, if the estate sells or transfers real estate, the title company or the buyer’s attorney will usually require a NJ realty tax waiver or a substantial escrow at time of closing.

Call us to schedule a free telephone consultation with an experienced tax accountant. We will explain the procedures regarding the issuance of tax waivers, and other important issues. We will also answer your questions and give you an approximate fee quote for our services.