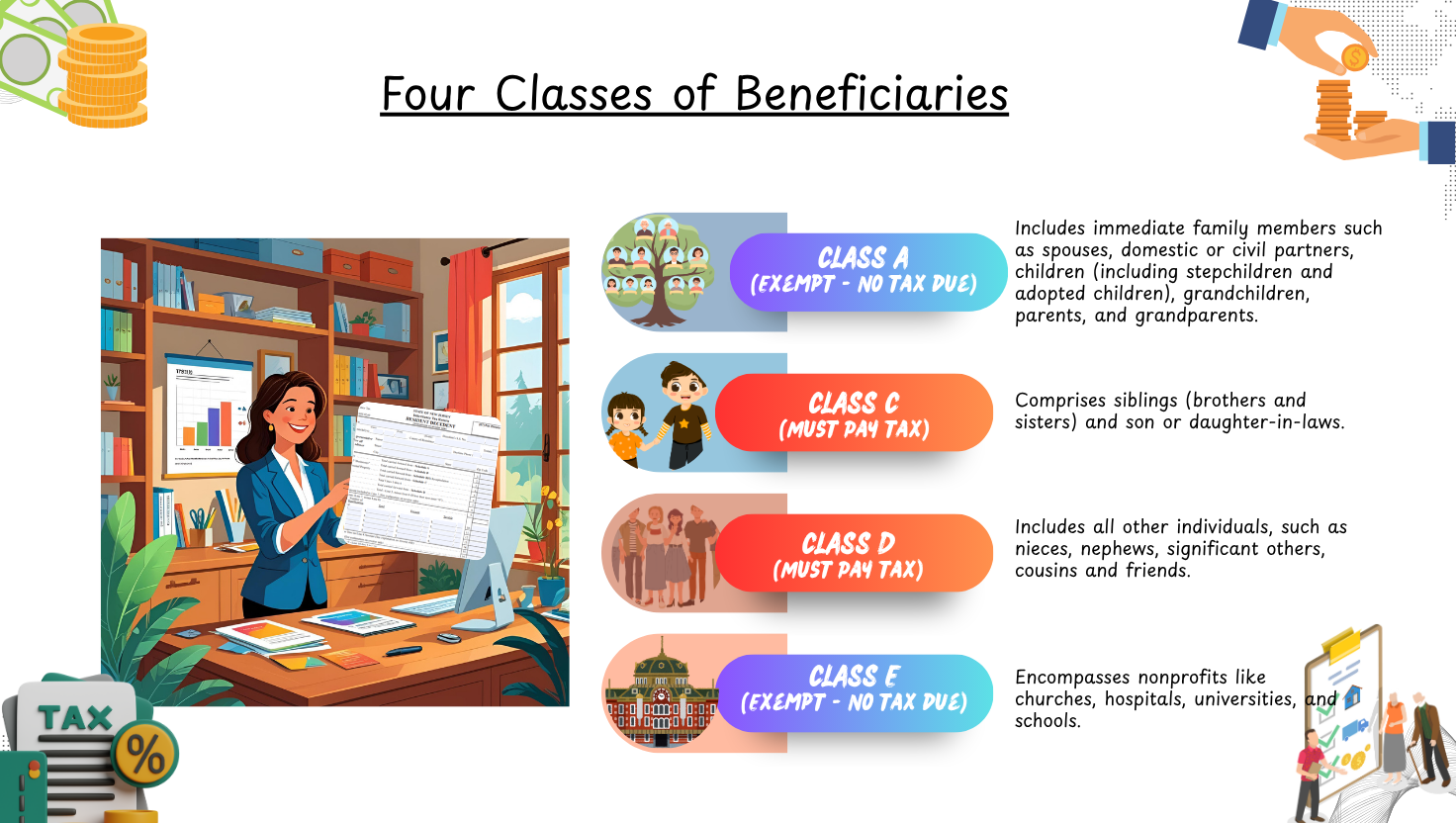

New Jersey classifies inheritance beneficiaries into four groups: Class A, Class C, Class D, and Class E. Notably, Class B has been eliminated. Each class is subject to different tax rules:

Class A and Class E – Doesn’t Pay NJ Inheritance Tax

(Decedent’s spouse, parents, children, non-profits, see below for full list)

Class C and Class D – Must Pay NJ Inheritance Tax

(Decedent’s brothers/sisters, nephews/nieces, cousins, friends, significant others, see below for full list)

- Class A: Includes immediate family members such as spouses, domestic or civil partners, children (including stepchildren and adopted children), grandchildren, parents, and grandparents. Class A beneficiaries are exempt from inheritance tax.

- Class C: Comprises siblings and in-laws (sons- or daughters-in-law). The first $25,000 of inheritance is tax-free, with amounts above $25,000 taxed at rates starting at 11% and capping at 16%.

- Class D: Includes all other individuals, such as nieces, nephews, significant others, cousins, and friends. Inheritance is taxed starting at $500, with rates ranging from 15% to a maximum of 16%.

- Class E: Encompasses nonprofits like churches, hospitals, universities, and schools. Class E beneficiaries are fully exempt from inheritance tax.